How to calculate cost of borrowing

The formula to calculate simple interest is. Use this calculator to find out how much a loan will really cost you.

Difference Between Lease And Finance Economics Lessons Accounting Basics Finance

Use the personal loan calculator to find out your monthly payment and total cost of borrowing.

. Get Your Loan In 24 Hours. Enter the amount into the box. For example if you take out a five.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. Principal loan amount x Interest rate x Time aka Number of years in term Interest. This will show you how the interest.

0005 x 20000 100. Deep Historical Options Data with complete OPRA Coverage. Analytic and Tick Data.

Service website has a mortgage calculator and mortgage affordability. The interest cost over 25 years in 50053. The total amount of debt is 300000.

What this means is that you will get charged 20 interest on your short position annually for being able to borrow the shares. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year.

40000 9 3125 Eligible Borrowing Cost 32875 W3. Cost of Borrowing Calculation. Ad Compare 10 Best Personal Loans 2022.

Principal Total Amount Borrowed Interest Fees APR Total Cost of Borrowing What this shows is theres more to loans than just interest. Before you do you should check out the true costs of such a loan with this calculator. If you borrow a 250000.

You can calculate your total interest by using this formula. The total annual interest for those two loans will be 12000 6 x 200000 plus 4000 4 x 100000 or 16000 total. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

30 years Interest rate. Pre-Tax Cost of Debt 28 x 2. The calculator is mainly intended for use by US.

The frequency of repayments for. Type into the personal loan calculator the Loan Amount you wish to borrow. Ad Low Interest Loans.

The formula to calculate simple interest is. Heres a simplified way of looking at it. Opens new window Select the term for your loan.

006 divided by 12 0005. Use our interest rate calculator to see how interest rates affect borrowing and saving. If I had a short position of 50000 in XYZ my.

The borrowing cost that relates to the qualifying asset and which will be capitalized in case of specific loan will be calculated as follows. This will show you how the interest rate affects. So the cost of.

Even if the difference in interest rate is only half a percentage point the. How to use our calculator Choose how much you want to save or borrow. Input the Annual interest rate for the loan.

Your total minimum monthly debt is divided by your. Want to Learn More. That 100 is how much youll pay in interest in the first month.

The amount you want to borrow. Calculate Your Rate in 2 Mins Online. Ad Rich options pricing data and highest quality analytics for institutional use.

Required Calculate the eligible. Working out the true cost of borrowing means taking into account. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Since the interest rate is a semi-annual figure we must convert it to an annualized figure by multiplying it by two. Semi-Annual Interest Rate 28. While your personal savings goals or spending habits can impact your.

Principal x rate x time interest with time being the number of days borrowed divided by the number of days in a year. However as you continue to pay your loan off more of your. Borrowing cost to be.

Annual percentage rate or APR is. Borrowing from a 401 k Thinking of taking a loan from your 401 k plan. The Banking Tech Awards USA Recognize Citizens Pay as a Best Innovation Bank for 2022.

The cost of any fees you might have to pay. Ad Successful in Serving More than 6 millions customers 80 Partners such as Microsoft.

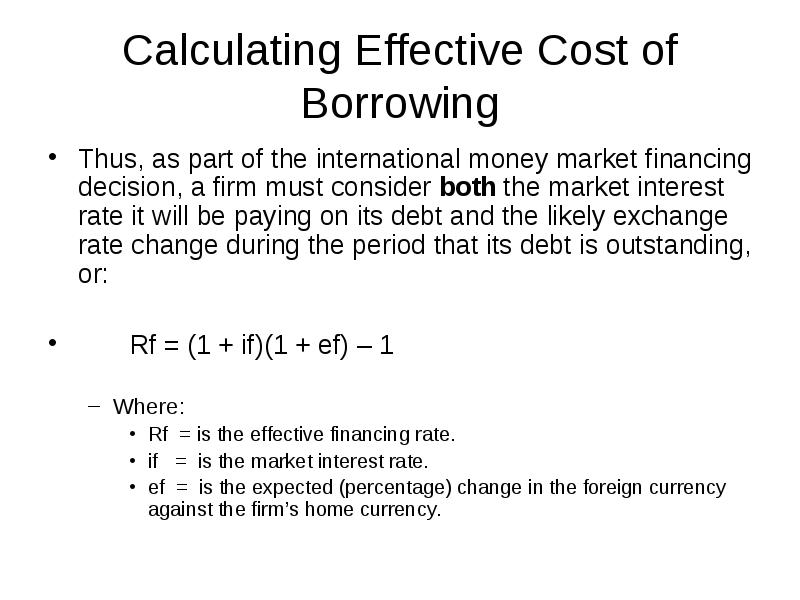

International Finance Chapter 18 Addendum Financing And Investing Short Term

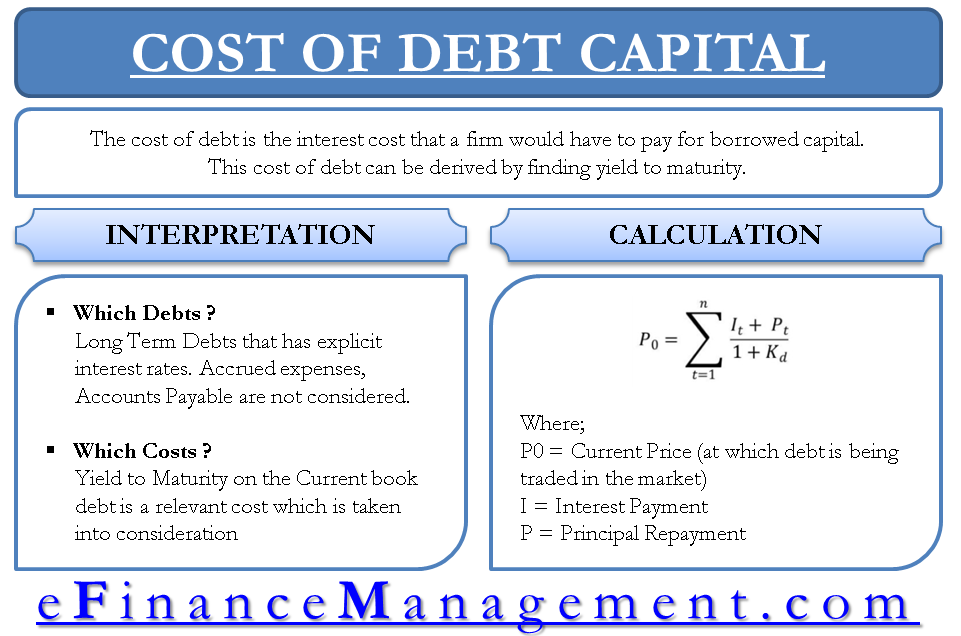

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

College Cost Calculator The College Board College Costs College Board Cost

Excel Formula Calculate Payment For A Loan Exceljet

How To Get A Loan From A Bank

Understand The Total Cost Of Borrowing Wells Fargo

Pin On Go Math 16 1 Grade 8 Answer Key

Cost Of Debt Kd Formula And Calculator Excel Template

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Journey To Becoming A Chartered Accountant Calculation Of Borrowing Cost

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Accounting For Borrowing Costs Overview And Example Accounting Hub

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Borrowing Base What It Is How To Calculate It

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm